How does my collection outlive me?

Take control of the future of your collection yourself.

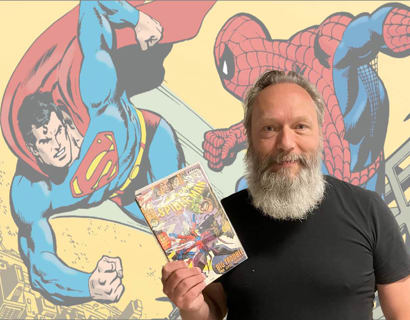

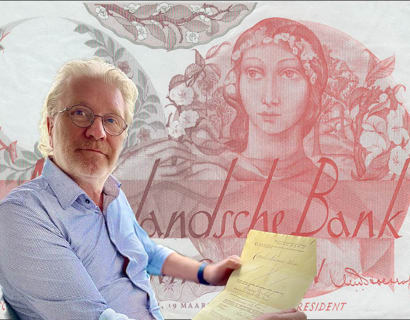

A family law notary often has collectors at their table. Whether they collect paper money, watches, comics, coins, bags, or old securities, it's almost always the same questions that are asked. Who will receive my collection when I'm no longer here?

It's good to think about your estate while you're still alive. Your collection is an important part of it. You can arrange for assistance in the settlement by including a settlement trustee in your will. CollectWeb is an excellent party to provide assistance with your estate. With 40 years of experience, our experts can advise you on how to handle everything.

Some advice for you and your loved ones!

After your passing, your collection will go to your heirs, so the first question is who they are. Please note: this article is applicable for Dutch law.The basis of inheritance law is actually quite simple. The law provides for a certain "standard inheritance," but you can deviate from it by making a will.

The first group of legal heirs includes the spouse and children (or possibly grandchildren if a child has passed away). If there is no spouse or children, then parents, siblings (or possibly nieces and nephews) come next in line. If they are also not present, then grandparents and their descendants (such as uncles, aunts, and their children) inherit. If no one from that group can be found, then great-grandparents and their descendants are considered. What many people do not realize is that unmarried partners, even if they have children together, do not inherit (in that case, the children inherit, not the partner).

As mentioned, you can deviate from this order by making a will and appointing whoever you want as an heir. There is actually only one rule, and that is that children have a minimum inheritance claim (the so-called legitimate portion). This doesn't mean that they become owners of the items, including the collection, for a specific portion, but rather that they are entitled to a certain portion of the value of the existing assets. If a child is disinherited (or at least does not receive the collection), the value of the collection will come into play. Heirs receive your entire estate - including debts! - or a fraction thereof. If you want to bequeath the collection, or a part of it, to specific individuals without involving them in the rest of the estate, you can create a specific bequest. This can be a simple bequest (the recipient doesn't have to compensate the other heirs), or a bequest with the obligation to contribute the value or a fixed amount. In the latter case, the legatee must compensate the heirs with the value of the (part of the) collection or the specified amount. Essentially, the legatee then has the right to purchase the collection.

Often, collectors want their collection to remain intact and not be sold off in parts after their passing. The survival of the collection largely depends on finding someone who shares the same passion. If you collect Porsches, Alpines, or Scanias, and your son is equally enthusiastic about them, then you're in luck. However, many collectors face the challenge of their family not sharing the same hobby, and if there isn't another equally passionate collector willing and able to take over the entire collection, the trail goes cold. After your passing, it may be the end of the road, and it's better to ensure that there's a way for your heirs to obtain a fair price for the collection. Of course, there are some collectors who can afford to establish a publicly accessible museum during their lifetime, but even then, it's uncertain whether it will continue to exist after the collector's passing.

To begin with, give your family an idea of the total value of your collection so that they understand the significant amount of money involved. However, having an idea of the total value doesn't necessarily mean they know the price tags that should be attached to each individual item when selling. As a collector of paper money, you know that a replacement note is worth more than a regular one, but for an average person, it's just the same bill. As an experiment, ask your wife or girlfriend to point out the ten most unique or valuable items from your collection; you'll be amazed! In short, don't leave your loved ones searching in the dark, and ensure that your heirs have some understanding of how to properly monetize the collection.

At least warn them about cherry picking, that friendly fellow collector who stops by and only buys the rare items, leaving the rest of the collection almost unsellable. Of course, a collection almost always fetches the highest value when the items are sold individually at fairs or through eBay or Marktplaats, but that requires a lot of work, so consider whether your loved ones are willing and able to do that. If that is indeed the intention, ensure that there is a complete list of the items with realistic selling prices. Ideally, include photos as well.

By the way, I would like to mention that carefully documenting the collection (including its value) can also be beneficial if you want to insure it. However, it can sometimes have a reverse effect, especially if a previously uninterested partner suddenly shows a keen interest in the collection—or more precisely, its value—when it comes to settling matters during a divorce or separation. But a prudent collector would naturally prevent such issues beforehand by establishing clear prenuptial agreements. Now, let's return to the deceased collector.

A very good solution can be to entrust the sale of the collection to a fellow collector who is well-informed about prices and sales channels, thus maximizing the proceeds for the heirs. In notarial terms, such a person is called a settlement administrator. A notary can draft a testament for collectors, including such a provision. If a settlement administrator performs their duties well, it can be a time-consuming task, depending on the size of the collection. Therefore, I recommend granting the settlement administrator not only reimbursement for expenses (such as travel expenses and renting a booth at a fair) but also a percentage of the realized proceeds from the sales as compensation for their efforts. A settlement administrator can explore various ways to sell a collection and will choose the method that yields the highest returns. Collectweb is one such settlement administrator.

It is also possible to donate, sell, or auction your collection during your lifetime, but most collectors, based on my experience, continue until the end. Unfortunately, I would say, because you are the only one who truly understands it. Therefore, selling it yourself during your lifetime or appointing an estate administrator through a testament is the wisest decision. The experts at CollectWeb are ready to assist you with it.

The tax authorities and your collection.

If you pass away and hold Dutch nationality, the tax authorities are also interested in your collection. But how does inheritance tax work exactly? Since 2010, the maximum inheritance tax rate is 40%. However, wild stories still circulate at social gatherings, swap meets, and birthdays, so I will conclude this article with a brief overview of exemptions and tax rates. All mentioned exemptions and rates apply to the year 2023 (they are adjusted annually), and more detailed information can be found on the website of the Tax Authorities (Belastingdienst). Inheritance tax only applies when the value of the inheritance exceeds the exemption threshold. No inheritance tax needs to be paid on the amount that falls within the exemption. The exemptions range from a generous €723,000 to as low as €2,400.

Exemption for partner

Partners are exempt from inheritance tax up to an amount of €723,000 in 2023. If you are married or have a registered partnership, you automatically qualify for this exemption. If you are unmarried and living together, it is advisable to establish a notarial cohabitation agreement in addition to having two wills. This ensures that you can make use of this exemption.

Exemption for child

Children have a much lower exemption of €23,000. Since your partner and children generally inherit equal shares for inheritance tax purposes, it is possible that a significant amount of inheritance tax will be owed on the portion that exceeds the children's exemption after your passing. By including a specific bequest (opvullegaat) in your will, you can avoid having to pay this inheritance tax immediately after the first death.

Exemption for grandchild

Grandchildren have the same exemption as children, which is €23,000. Grandchildren do not automatically inherit according to the law, so it may be beneficial to include a specific bequest for a grandchild in your will.

Exemption for other heirs

Other heirs such as siblings or parents only have an exemption of €2,400.

Inheritance tax must be paid on the amount above the exemption. The rates vary from 10% for partners to up to 40% for a friend or acquaintance. Below you will find the (rounded) rates.

Inheritance tax rates for partners

From € 723,000 partner exemption, the partner starts paying inheritance tax. Up to € 861,000, the rate is 10%, and for the amount above that (unlimited), it is 20%.

Inheritance tax rates for children

From € 23,000 child exemption, a child starts paying inheritance tax. Up to € 161,000, the rate is 10%, and for the amount above that (unlimited), it is 20%.

Inheritance tax rates for grandchildren

From € 23,000 child exemption, a grandchild starts paying inheritance tax. Up to € 161,000, the rate is 18%, and for the amount above that (unlimited), it is 36%.

Inheritance tax rates for other heirs

From € 2,400, other heirs such as siblings or parents start paying inheritance tax. Up to € 138,000, the rate is a substantial 30%, and for the amount above that (unlimited), it is 40%.

Appraisal form.

Request an appraisal!

We professionaly valuation and purchase

At Collectweb, you can easily and quickly have your valuables appraised. We appraise jewelry, watches, silver/gold objects, banknotes, securities, and coins. Our expert and experienced appraisers assess your items for free remotely via email and phone. Take advantage of it right away!

E-mail

Please send us an e-mail, and we will assess your items.

- Take clear photos or a short video.

- Provide a brief description of the object.

- Send it to corne@collectweb.com

- You will receive a response within a few days.

Telefoon

If you prefer to speak with us to explain your appraisal and items, please call us at tel. +31 (0)644 812 471.

Visit our office in Eindhoven

Call us, send us an email or fill in the form at left to make an appointment.

- Bring your collection to our office for evaluation by our expert.

- We can provide discreet and direct handling if desired.

At the collections location

Call us, send us an email or fill in the form at left to make an appointment.

- For special collections or large collections, we are happy to arrange a visit to your location.

- We can provide discreet and direct handling if desired.

You can also fill out the form on the left and send it to us, and we will contact you as soon as possible.